By Jeffrey J. Peshut

March 30, 2014

The U.S. has a rich agricultural heritage. This heritage includes an expansive body of wit and wisdom in the form of aphorisms, admonitions and advice that have been accumulated by farmers over hundreds of years of plowing and tilling fields, planting and harvesting crops, milking cows, etc.

“Don’t eat your seed corn!” is one of these admonitions. In literal terms, it suggests that farmers who choose to consume the corn from this year’s harvest that they will need for planting next year — rather than saving it for planting — will reduce crop production in the next year. Figuratively speaking, it refers to living beyond our means today at the cost of reducing our standard of living tomorrow.

Austrian Business Cycle Theory

In its January 14th post titled Does The Federal Reserve Really Create The Boom/Bust Cycle?, RealForecasts.com explained how the Federal Reserve creates the boom/bust cycle by artificially expanding the supply of money and credit, lowering interest rates below their market or “natural” level and thereby creating an unsustainable economic boom which inevitably results in a bust. According To Austrian Business Cycle Theory, one of the negative consequences of the boom/bust cycle is that it depletes an economy’s pool of funding.

Dr. Frank Shostak, adjunct scholar of the Mises Institute (www.mises.org) and principal of Applied Austrian School Economics, Ltd (http://aaseconomics.com) has written extensively about the pool of funding. According to Dr. Shostak, the pool of funding is made up of all of the final products and services produced by an economy. In the case of an individual farmer, the pool of funding is made up of the farmer‘s entire corn harvest.

It is important to recognize that an economy’s pool of funding is produced to be consumed by individuals to support their standard of living, just as the individual farmer’s crop harvest is produced to be consumed by the farmer and his family to support their standard of living. Not all of the pool of funding can be consumed, however. For consumers to maintain their standard of living, they must save enough of the pool of funding to maintain the current level of production of final products and services. This is known as the economy’s pool of real savings – its “seed corn” if you will.

For consumers to improve their standard of living, an economy must increase its productive capacity and production. To increase the economy’s productive capacity, producers must invest in the production of better tools, equipment, machinery, etc. To make the resources available for investment, consumers must save more than the minimum required to simply maintain the current level of production. They must increase the size of the pool of real savings. Of course, to save more, they must consume less.

For example, to improve their standard of living, the farmer and his family must cut back on corn consumption today to save enough to invest in a better tractor, better farm implements to be used with the tractor or education to learn better farming techniques. These investments, in turn, will allow them to produce more corn in the future and raise their standard of living.

Thus we can see that the pool of funding can be used for either current consumption or saved and invested for future production.

It’s important to recognize that the use of money in an economy doesn’t change the essence of the pool of funding. Products and services are paid for with products and services – not with money. Money is simply a medium of exchange that facilitates the transactions. The farmer exchanges corn for money and then exchanges the money for boots. The boot maker exchanges his boots for money and then exchanges the money for corn. Ultimately, however, the farmer pays for the boots with the corn he produces and the boot maker pays for corn with the boots he produces.

So, how does the artificial expansion of the supply of money and credit, the lowering of the interest rate and the unsustainable boom and inevitable bust deplete the pool of funding? It depletes it in two ways.

When the Federal Reserve expands the money supply, it creates money out of “thin air”. The holder of the newly-created money can exchange it for final products and services in the pool of funding without having made a prior contribution of final products and services to the pool. They can consume without having produced. As a result, there are now less products and services left in the pool of funding than there were before the Fed expanded the money supply. The pool of funding has been partially depleted.

Also, when the Federal Reserve lowers interest rates below their market or “natural” level, it sends a misleading signal to producers about consumers’ true time preferences. As the Fed drives down interest rates, producers are led to believe that consumers are saving more today to consume more in the future and that now is the time to take advantage of the lower interest rates and invest in longer-term production projects for new products in the future. In fact, consumers haven’t said that they want to save more today and consume more in the future. Because the holders of the newly-created money used it to siphon off products and services from the pool of funding, consumers may demand more products and services today just to consume the same amount as the have been consuming.

Similarly, just because the Fed has decided to force interest rates down, it doesn’t mean that consumers want to invest more of their savings to complete future production capacity and future production. As suggested above, people may not only prefer to continue to consume the same amount of resources today, they may want to consume even more. This creates an unchanged or even shrinking pool of real savings from which to fund a growing number of new investment projects.

Something has got to give. The boom in economic growth precipitated by the artificial creation of money and credit and lower interest rates is not sustainable. The bust is inevitable.

The bust may occur because producers incorrectly forecasted future consumer demand for the future supply of their products and services. As a result, these projects will become unprofitable. It may also occur because producers incorrectly forecasted the size of the pool of real savings from which to complete their future projects and they won’t be able to complete them. It can even occur because the Fed decides to reverse its monetary policy – from a “loose” policy stance to a “tight” policy stance – based upon a concern about how the increase in the money supply will affect consumer prices, asset prices or the price of the dollar relative to other currencies. But occur it must.

Once the bust occurs, the market liquidates the unsustainable projects or “malinvestments”. All or part of the pool of real savings that was invested in these projects is lost or “consumed” by the unsustainable and unsuccessful projects. The result is a further depletion of the pool of funding.

According to Austrian Business Cycle Theory, then, the Fed’s intervention in the markets for money and credit creates the boom/bust cycle and depletes the pool of funding and the pool of real savings. To the extent the Fed’s intervention depletes the pool of real savings, we are in fact “eating our seed corn” and thereby reducing both producers’ ability to maintain and improve their productive capacity and production and consumers’ ability to maintain and improve their standard of living.

But does the data back this up?

Empirical Data

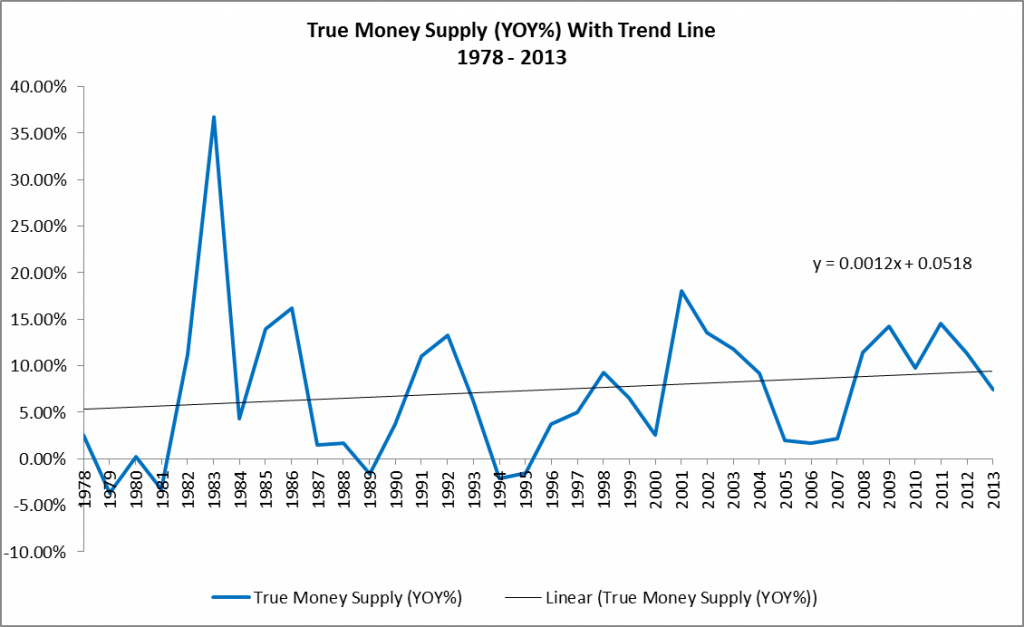

The chart in Figure 1 shows year-over-year percentage increases and decreases in the True Money Supply from 1978 through 2013. The positive slope of the trend line shows that, overall, the True Money Supply has been increasing at an increasing rate over the past 35 years.

Figure 1: True Money Supply (YOY%) With Trend Line 1978 – 2013

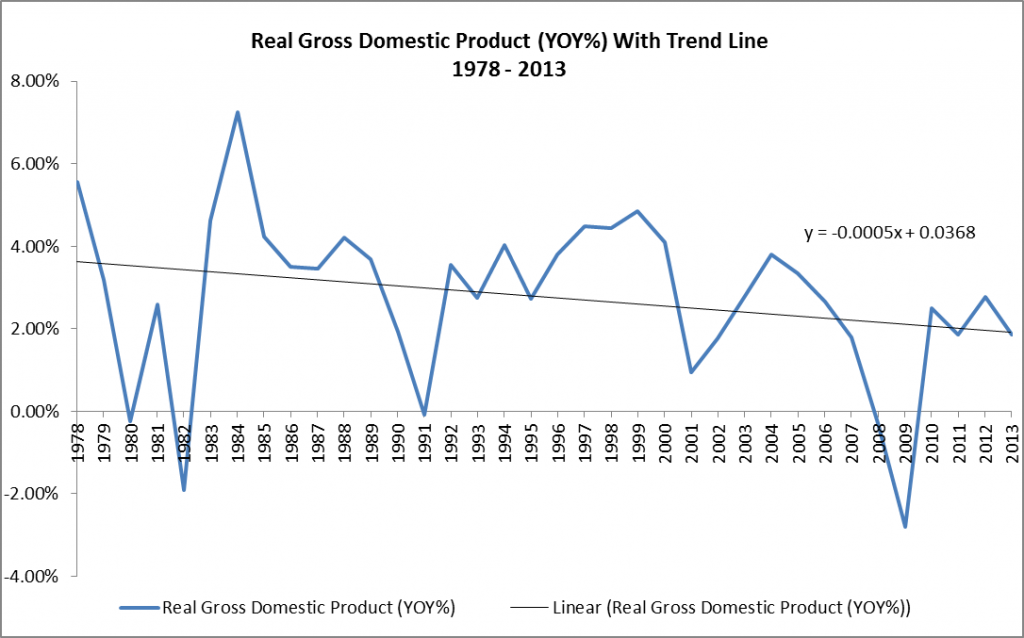

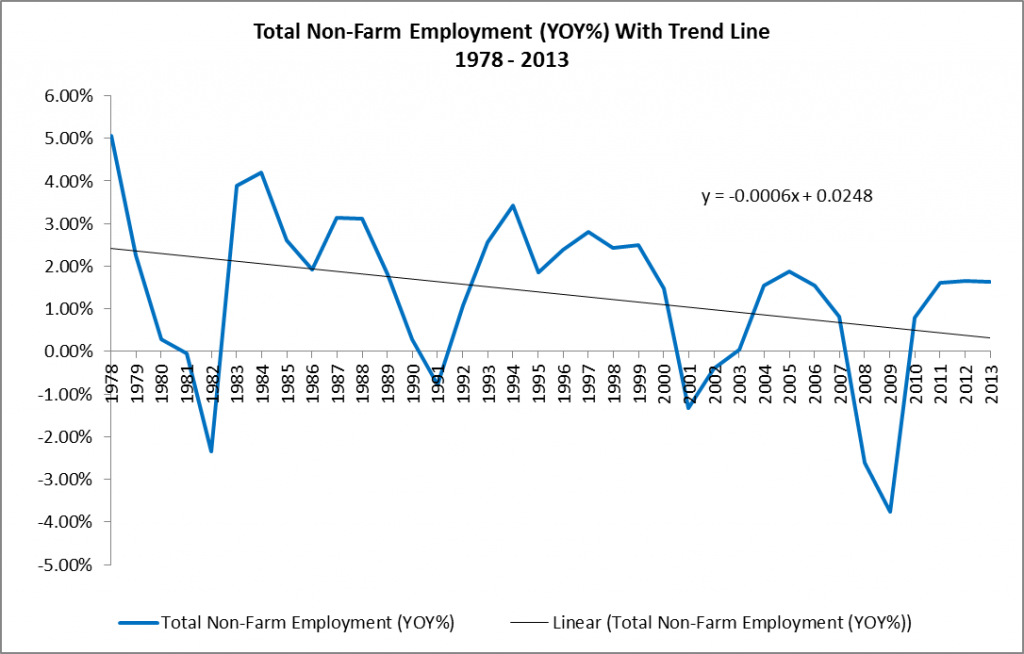

The charts in Figure 2 and Figure 3 show year-over-year percentage increases and decreases in the Real Growth Domestic Product and Total Non-Farm Employment, respectively, from 1978 through 2013.

The negative slope of the trend line in Figure 2 shows that, overall, Real Gross Domestic Product has been increasing at a decreasing rate over the past 35 years.

Figure 2: Real Gross Domestic Product (YOY%) With Trend Line 1978 – 2013

Similarly, the negative slope of the trend line in Figure 3 shows that, overall, Total Non-Farm Employment has also been increasing at a decreasing rate over the past 35 years.

Figure 3: Total Non-Farm Employment (YOY%) With Trend Line 1978 – 2013

The acceleration in the growth of the True Money Supply and the deceleration in the growth of the GDP and Total Non-Farm Employment supports the Austrian School’s view that the Fed’s intervention has in fact been depleting the pool of real savings in the U.S. — i.e., we have been “eating our seed corn” — and that this has reduced the ability of producers to maintain and improve their productive capacity and levels of production.

Say’s Law and the Permanent Recession

In Say’s Law and the Permanent Recession, Robert Blumen argues that the most recent recession, often called The Great Recession, actually began in 2000 and not in 2008 and that there has been little if any real economic growth in the U.S. since 2000:

John Williams, an economic statistician and the proprietor of the web site Shadowstats, has produced a version of the real GDP based on the government’s nominal GDP deflated by his own GDP deflator. (The GDP deflator is sort of like the CPI, a price index that is used to convert nominal GDP into real GDP. For some reason they don’t use the same price index for both consumer prices and for this). Like Williams’ own CPI, his GDP deflator is computed with older rules from before the time when the BLS began cooking the books to hide inflation. Williams’ measure of real GDP shows low to negative growth over the period since 2000.

Robert’s article further supports the Austrian School’s view presented by RealForecasts.com in this post.

Refilling Our Seed Corn Bins

To increase producers’ ability to maintain and improve their productive capacity and production — and consumers’ ability to maintain and improve their standard of living — the Federal Reserve must first stop creating money out of thin air and expanding the supply of money and credit, allow the market to liquidate the unsustainable projects or “malinvestments” and allow interest rates to return to their natural levels. Once this occurs, interest rates can begin to play their role of coordinating production over time — matching the production of goods and services with consumers’ true time preferences for consuming today or saving today and consuming tomorrow. The pool of funding and the pool of real savings will be replenished. Unlike a credit-fueled boom, which is unsustainable, savings-based growth is sustainable. Consequently, over time, the economy will gradually return to health.

Or, to paraphrase our metaphorical farmers with whom we began, we must “stop eating our seed corn” and begin refilling our seed corn bins.

As always, my thanks to J. Michael Pollaro of The Contrarian Take who provided the TMS data used to create the chart in Figure 1.