By Jeffrey J. Peshut

August 2, 2015

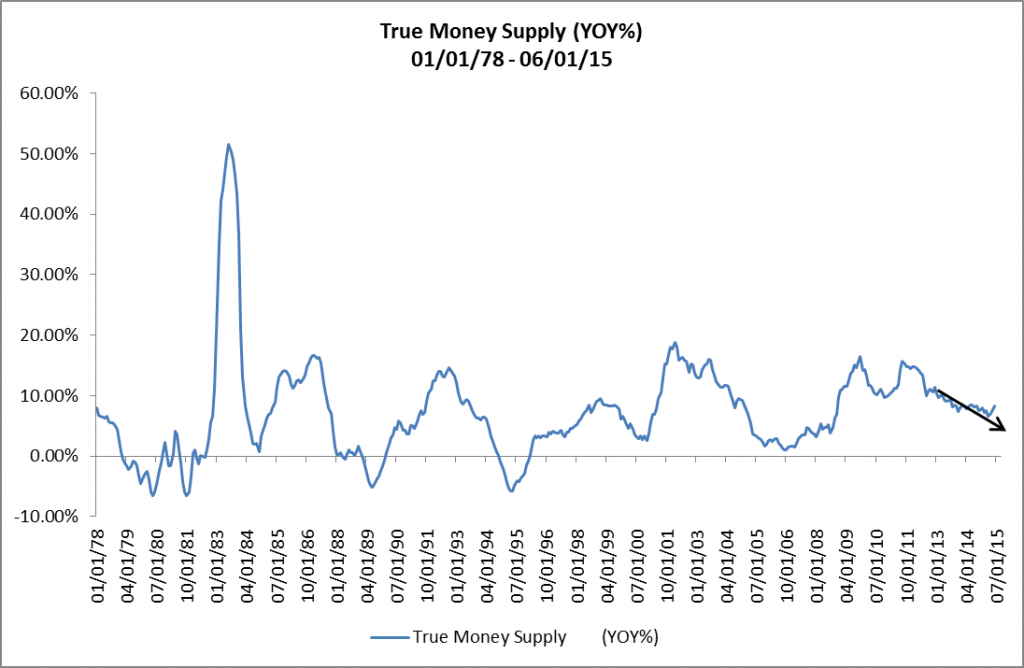

With the growth rate of the True Money Supply (TMS) expected to continue its inexorable decline towards the next financial crisis, what steps can real estate investors take to manage through the bust phase of the cycle? This post will address that question. But first, let’s take a look at what’s been happening with the TMS growth rate over the past several months.

TMS Growth Rate

For June, 2015, the year-over-year growth rate of TMS was 8.26%. (See Figure 1) This was up from 7.72% in the previous month and the highest level reported since the end of the QE3 “Taper” in October of 2014. The lowest level reported since October was 6.53% in March of this year.

Figure 1: True Money Supply (YOY%) 01/01/78 – 06/01/15

Despite this recent uptick, RealForecasts.com expects the growth rate of TMS to continue the downward trend shown by the arrow in Figure 1, especially once the FOMC raises the Fed Funds Target Rate above its current ceiling of 25 bps later this year. For a more in-depth discussion see, How Will The End Of Quantitative Easing Impact The True Money Supply Growth Rate?

What Steps Can Real Estate Investors Take To Manage Through The Next Bust?

The two most important steps that real estate investors can take to manage through the next bust is to first shift the way they look at the economy and financial markets from “linear” to “cyclical” and then shift their investment mindset from “relative” to “absolute”. It’s human nature to forecast in a linear fashion. If the economy and financial markets are going up, it’s natural for investors to forecast that they will stay up and even continue to go up in the future. If the economy and financial markets are going down, it’s also natural for investors to forecast that they will stay down and even continue to go down in the future.

Yet the economy and financial markets don’t behave that way. They are nothing if not cyclical.

Also, most investors — especially institutional investors — have adopted a relative return mindset for their portfolios and measure their performance and the performance of their investment managers against market benchmarks or indices. A relative return strategy performs well, however, only when the overall market performs well. That said, if the overall market doesn’t perform well, but the investor or manager outperforms the market benchmark or index, they are still deemed to have performed well. That sounds good in theory, but as the saying goes, “you can’t eat relative performance”. Practically speaking, even if an investor’s negative returns weren’t as great as the negative returns posted by the market as a whole, they still lost money.

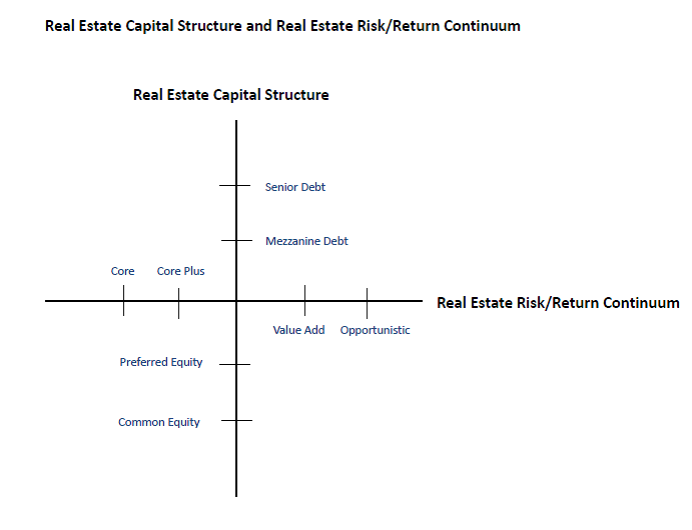

A portfolio based upon an absolute return strategy, on the other hand, is designed to provide positive returns regardless of the direction of the overall market. Investors following an absolute return strategy will generate these positive returns by investing up and down the real estate capital structure (common equity to senior debt) and back and forth along the real estate risk/return continuum (core to opportunistic), depending upon where the real estate capital markets and real estate property markets are in their cycles. Figure 2 shows the universe of investment alternatives available to real estate investors by the risk profile of the investment and the investor’s position in the capital structure for the investment.

Figure 2: Real Estate Capital Structure and Real Estate Risk/Return Continuum

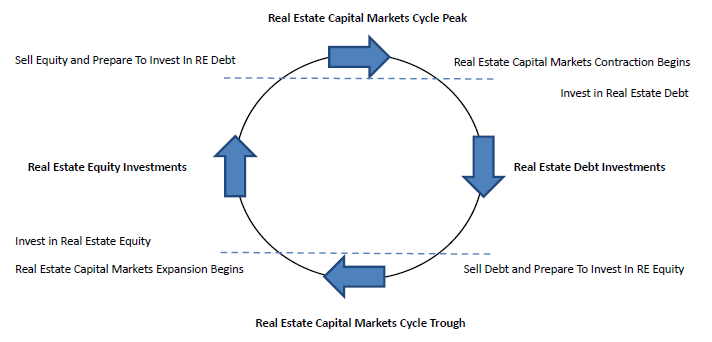

The following section indicates where investors should position themselves in the capital structure based upon where the Real Estate Capital Markets are in their cycle.

Real Estate Capital Markets Cycle

If the Real Estate Capital Markets are either currently in or forecasted to move into the Expansion phase of the cycle, invest in real estate equity investments to take advantage of cap rate compression and appreciating capital values. If the Real Estate Capital Markets are in or forecasted to move into the Contraction phase of the cycle, rotate out of equity investments and into real estate debt investments to avoid cap rate decompression and depreciating capital values. (See Figure 3) Depending upon the investor’s risk tolerance and return objectives, equity investments can take the form of either preferred equity or common equity. Debt investments can take the form of senior debt or mezzanine debt.

Figure 3: Real Estate Capital Markets Cycle – Indicated Investment Types

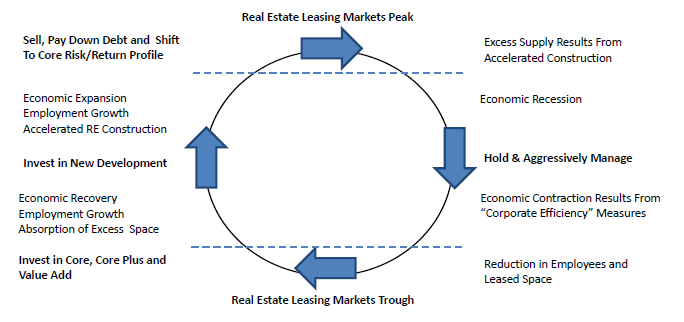

The following section indicates where investors should position themselves on the real estate risk/return continuum based upon where the Real Estate Leasing Markets are in their cycle.

Real Estate Leasing Markets Cycle

When the Real Estate Leasing Markets are in the Recovery phase of the cycle, invest in existing core, core plus and value–added investments to take advantage of rising occupancy rates, lease rates and capital values. During the Expansion phase of the Leasing Markets’ cycle, add opportunistic investments in new developments. If the Real Estate Leasing Markets are forecasted to move into the Recession and Contraction phases of the cycle, sell properties, pay down debt and rotate into core risk/return investments. (See Figure 4)

Figure 4: Real Estate Leasing Markets Cycle – Indicated Investment Types

Takeaways

RealForecasts.com expects that the growth of TMS will continue its downward trend in the months ahead, especially once the FOMC raises the Fed Funds Target Rate above its current ceiling of 25 bps later this year. Based upon the current trajectory of this trend, and the Fed’s current policy stance, it looks like the next credit crisis could occur during the second half of 2016. Of course, this forecast could change if the Fed changes its policy stance or if the commercial banks change the pace of lending activity.

In the meantime, it’s not too early for real estate investors to take advantage of the robust capital markets environment to begin selling some of their under-performing and less-strategic assets and using the proceeds to reduce the leverage on their portfolios. By “dealing from the bottom of the deck” and reducing leverage, they will be improving the risk profile of their portfolios in anticipation of — and not in reaction to — the next downturn.

Many thanks to Michael Pollaro at The Contrarian Take for the TMS data used in this post.

Very strong and interesting content. Thanks for doing all this work and posting!

Pingback: Where Are The Real Estate Credit Markets In Their Cycles? | RealForecasts.com

Pingback: Where Are The Real Estate Credit Markets In Their Cycles? - RealForecasts.com