By Jeffrey J. Peshut

March 26, 2015

At its March 18th meeting, the Federal Open Market Committee (“FOMC”) withdrew its pledge to be “patient” about raising the Fed Funds Target Rate above its current target range of 0 to 25 basis points, thus ending “forward guidance” about its policy stance and allowing the FOMC more freedom and flexibility about the timing of a rate increase. The FOMC indicated that as long as the employment market continues to improve, the FOMC will raise the Fed Funds Target Rate once it becomes “reasonably confident” that inflation will approach 2% over the medium term. The FOMC added that a rate increase remained “unlikely” at its April meeting and said its change in rate guidance does not mean it has decided on the timing for a rate hike. Fed Chair Janet Yellen later told reporters that a June move could not be ruled out.

Notwithstanding the FOMC’s statement – and despite the keen attention paid to it by Fed watchers — one question that no one seems to be asking is whether the Fed has already been raising the Fed Funds Rate under the radar. This post addresses that question. Before addressing it, however, let’s first review some monetary policy basics.

Monetary Policy and Policy Tools

The Federal Reserve uses monetary policy to influence the supply of money and credit in the U.S. economy. The supply of money and credit, in turn, affects interest rates and the performance of the U.S. economy and financial markets.

Traditionally, the Federal Reserve has used three tools to implement its monetary policy:

- Fed Funds Rate – The average rate at which a depository institution (DI) — or other eligible entity such as a foreign bank or government sponsored enterprise — makes an unsecured overnight loan of U.S. dollars to another DI (“Fed Funds Transaction”). A DI borrows money overnight from another DI to maintain its reserve balances or clear financial transactions.

- The Discount Rate – The rate charged by Federal Reserve Banks to depository institutions (DIs) on short-term loans.

- The Reserve Requirement – The reserve requirement is the percentage of its customer deposits that each DI must hold as reserves – rather than lend out – either in their vaults or on deposit at a Federal Reserve Bank.

Since October of 2008 the Fed has been using the payment of interest on reserves as a fourth policy tool and from December of 2008 to October of 2014 the Fed used Quantitative Easing (“QE”) as a fifth tool.

Up until the fourth quarter of 2008 — when the Fed adopted a Zero Interest Rate Policy (ZIRP), reduced the Fed Funds Target Rate to nearly zero, began paying interest on reserves and initiated QE – raising and lowering the Fed Funds Rate had been the Fed’s primary policy tool. To implement its monetary policy, the FOMC would set a target level or range for the Fed Funds Rate consistent with the desired level of reserves and then use its open market operations to influence the reserve balances until the Fed Funds Effective Rate reached its target rate.

The Fed’s open market operations influence reserve balances by purchasing and selling financial instruments — which are usually securities issued by the U.S. Treasury, Federal agencies and government-sponsored enterprises (GSEs) — in the “open market”. Open market operations are carried out by the Domestic Trading Desk of the Federal Reserve Bank of New York under direction from the FOMC. The transactions are executed through a cadre of security dealers that the Fed regularly does business with, which are known as “primary dealers”.

When the Fed wants to increase reserves and thereby lower the Fed Funds Effective Rate, it buys securities and pays for them by making a deposit to the account maintained at the Fed by the primary dealer’s bank. When the Fed wants to reduce reserves and thereby raise the Fed Funds Effective Rate, it sells securities and makes a withdrawal from these accounts. Most of the time, the Fed does not want to permanently increase or decrease reserves, so it reverses these transactions within several days.

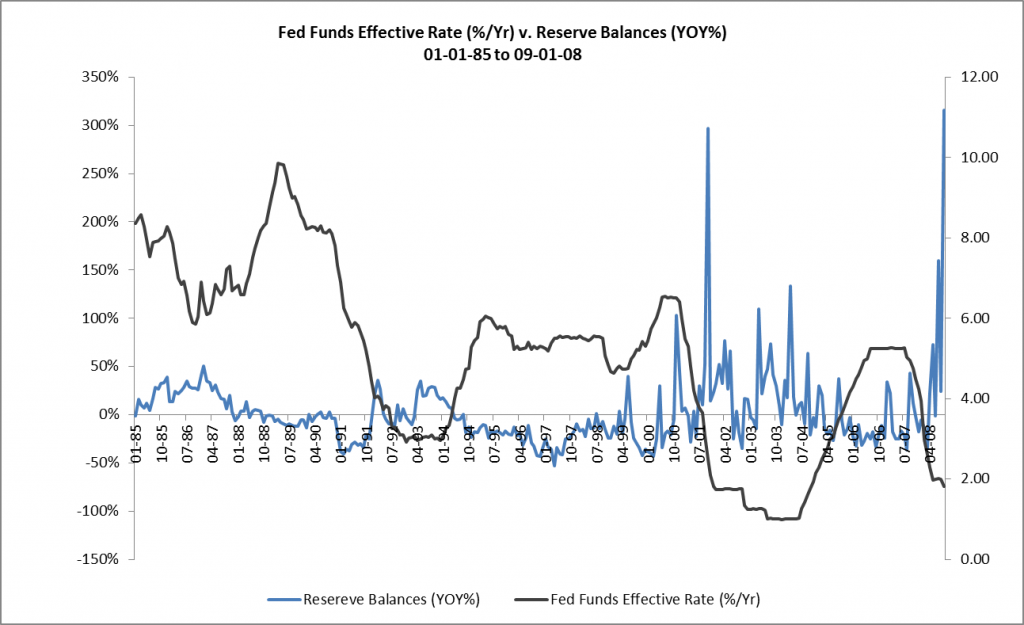

Figure 1 illustrates how changes in reserve balances influenced the Fed Funds Effective Rate from the beginning of 1985 through the third quarter of 2008. When reserve balances decreased, the Fed Funds Effective Rate increased and when reserve balances increased, the Fed Funds Effective Rate clearly decreased.

Figure 1: Fed Funds Effective Rate (%/Yr) v. Reserve Balances (YOY%) 01-01-85 to 09-01-08

How Did Quantitative Easing Impact Reserve Balances?

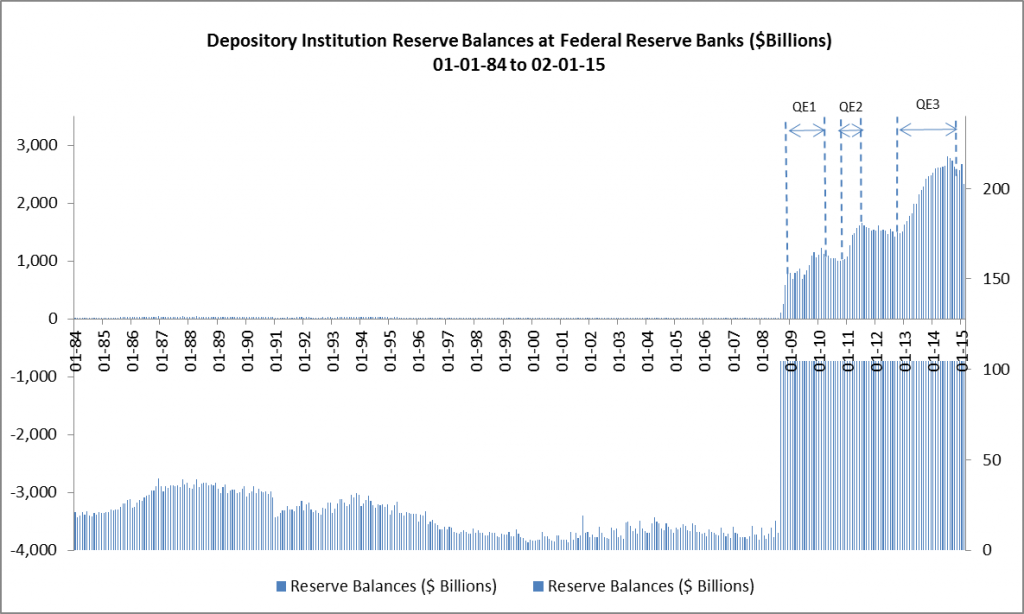

Once the Fed lowered the target Fed Funds Target Rate into the 0 to 25 bps range, QE replaced the Fed Funds Rate as the Fed’s primary policy tool. The impact on reserve balances was both immediate and remarkable. (See Figure 2.) Because the increase was so great, I’ve used a panel chart to be able to see the reserve balances before QE and the reserve balances after QE on the same chart.

Figure 2: Depository Institution Reserve Balances at Federal Reserve Banks ($Billions) 01-01-84 to 02-01-15

Reserve balances went from $847.82 billion at the beginning of QE1 in December of 2008 to $1.12 trillion at the end of QE1 in March of 2010, to $1.62 trillion at the end of QE2 in June of 2011 and to $2.63 trillion at the end of QE3 in October of 2014.

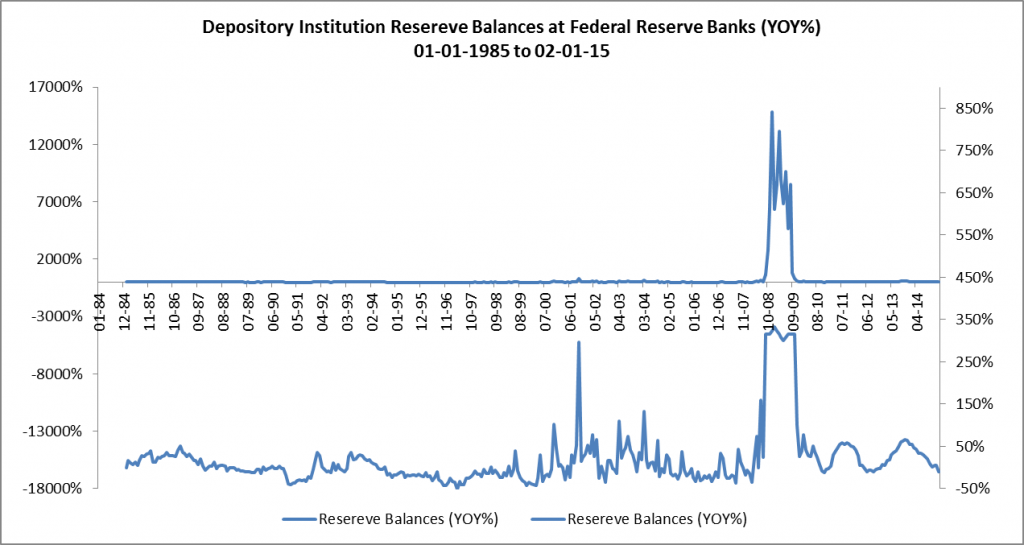

The greatest increase in reserves on a on a year-over-year percentage basis actually occurred in the year leading up to QE1 when reserve balances went from a mere $5.67 billion in December of 2007 to the previously mentioned $847.82 billion in December of 2008, a head-spinning year-over-year increase of over 14,800%! (See Figure 3.) Again, a panel chart allows us to see the year-over-year percentage change before QE and the year-over-year percentage change after QE on the same chart.

Balances at Federal Reserve Banks (YOY%) 01-01-85 to 02-01-15

Why Did The Fed Start Paying Interest On Reserves?

The aggressive expansion of the Fed’s various liquidity facilities caused a large increase in excess reserve balances that placed extraordinary downward pressure on the Fed Funds Effective Rate. This made it difficult for the Fed to achieve the operating target for the Federal Funds Rate set by the FOMC. According to the Fed, paying interest on reserves allowed it to increase the level of reserves and still maintain control of the Federal Funds Rate.

Because depository institutions have little incentive to lend in the overnight inter-bank Fed Funds market at rates below the interest rate on excess reserves, paying interest on reserves allows the Fed to effectively place a floor on the Fed Funds Rate. This floor allows the Fed to keep the Fed Funds Effective Rate closer to its target rate than it would have been otherwise able to.

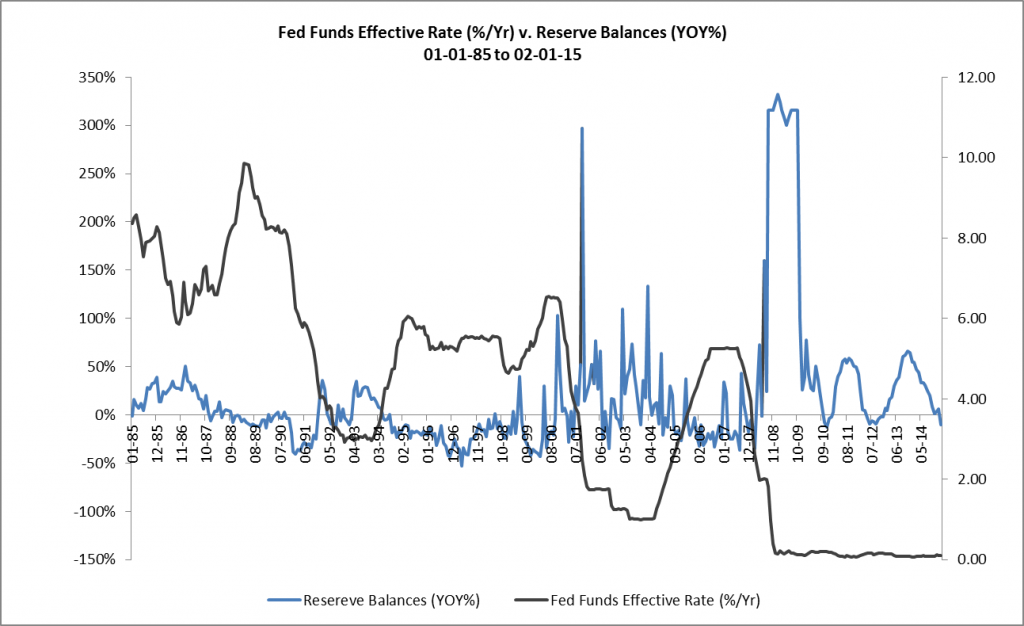

Some commentators argue that once the Fed began paying interest on reserves and reduced the Fed Funds Target Rate to a range of 0 to 25 bps, it effectively decoupled changes in the Fed Funds Effective Rate from changes in reserve balances in the banking system. They say that the Fed can now adjust reserve balances independently of the Fed Funds Effective Rate and that therefore the Fed Funds Rate is no longer a relevant policy tool. As a result, they believe that the keen attention that people are paying to the timing of the Fed’s increase in the Fed Funds Rate is misplaced.

At first glance, Figure 4 would seem to support these commentators’ argument. From December 2008 until today, the Fed Funds Effective Rate has been range bound between 0 and 25 bps while reserve balances have been growing at exponential rates.

Figure 4: Reserve Balances (YOY%) v. Fed Funds Effective Rate (%/Yr) 01-01-85 to 02-01-15

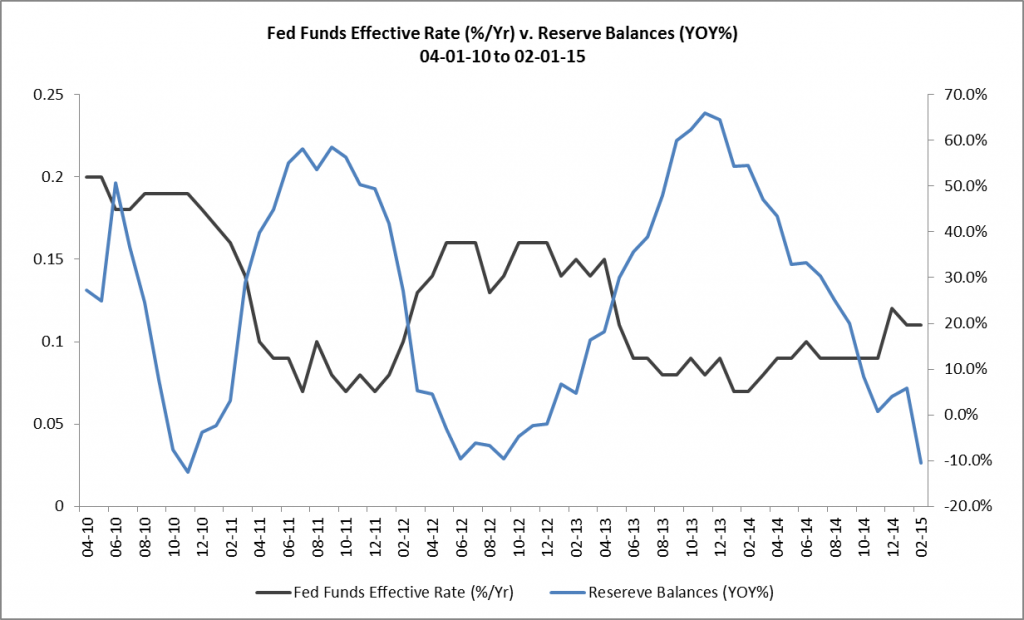

If we zoom into the portion of the chart that relates to the period after QE1, which ended in March of 2010, we see that the relationship between changes in reserve balances and changes in the Fed Funds Effective Rate is as strong as it has ever been. (See Figure 5.) The changes in the Fed Funds Effective Rate are just occurring on a much smaller scale!

Figure 5: Reserve Balances YOY% v. Fed Funds Effective Rate (%/Yr) 04-01-10 to 02-01-15

We also see that the Fed’s “Taper” policy that began at the beginning of 2014 has reduced reserve balances from a high of $2.8 trillion in July of 2014 to $2.3 trillion in February of this year — a reduction of 18% in eight months. This decrease in reserve balances has raised the Fed Funds Effective Rate from 7 bps in January of 2014 to 11 bps in February of this year — an increase of more than 57% in a little over a year.

So, to answer the question raised at the beginning of this post, the Fed has indeed been raising the Fed Funds Effective Rate under the radar since January of 2014. They’ve just been using the tapering of Quantitative Easing to reduce reserve balances instead of the more traditional method of raising the Fed Funds Target Rate.

What’s Next For Reserve Balances and The Fed Funds Rate?

To continue to raise the Fed Funds Effective Rate, watch for the Fed to reduce reserve balances in the months ahead. It’s unlikely that the Fed will begin to raise the Fed Funds Target Rate until the Fed Funds Effective Rate approaches 25 bps, the upper limit of its current target range for the Fed Funds Rate. Once the Fed does raise the Fed Funds Target Rate, the Fed Funds Rate should retake its place as the Fed’s primary policy tool and we’ll once again be able to pick up changes in the Fed Funds Rate on our radar screens.

Federal Reserve actions have served to disconnect interest rates from reality. Micro managing of macro events will lead to financial chaos. This is hubris at work. Many persons, whose resources would otherwise see them comfortably through retirement have been denied that choice by such actions. This will not end well.