Is True Money Supply (TMS) Growth Continuing To Decelerate?

By Jeffrey J. Peshut

July 16, 2014

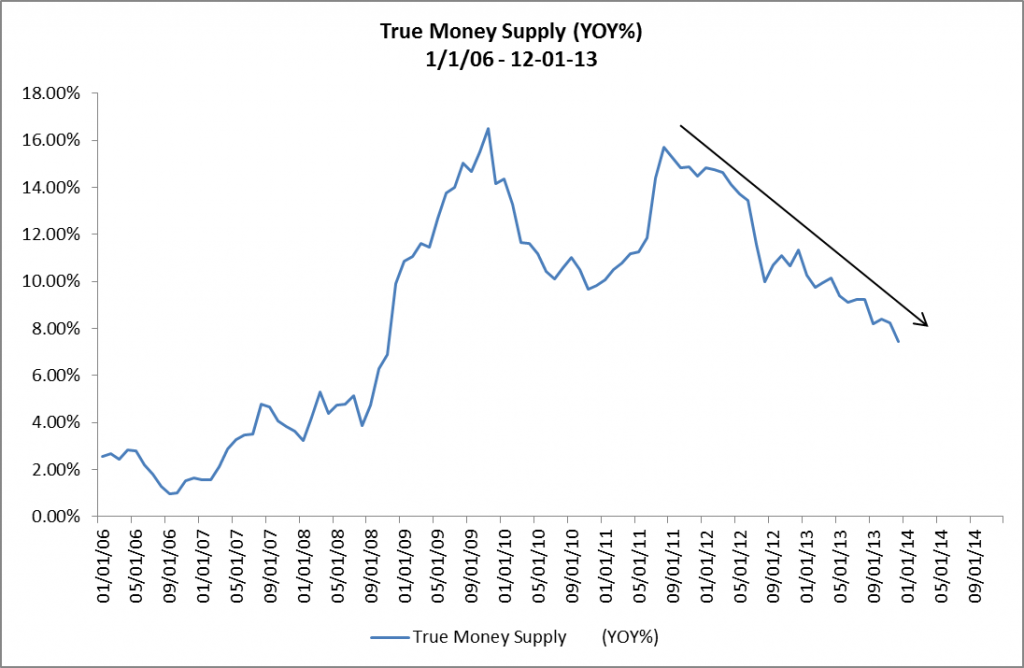

In its most recent posts — What’s Next For Employment Growth?, Will GDP Growth Continue To Lose Momentum? and Where Will Commercial Real Estate Returns Go From Here? — RealForecasts.com showed that the rate of growth of TMS had been decelerating since September, 2011. (See Figure 1.)

Figure 1: True Money Supply (YOY%) 1/1/06 – 12-01-13

Moreover, at the end of each of these posts, RealForecasts.com encouraged readers to continue to monitor the Fed’s actions during 2014 to anticipate changes in TMS. To that point, it’s been widely publicized that the Fed has been reducing or “tapering” its bond purchases under QE3, from a high of $85 billion per month in November of 2013 down to $35 billion per month in July of 2014. Based on a roughly $10 billion per meeting tapering schedule, the last QE3 purchases should occur in October of 2014.

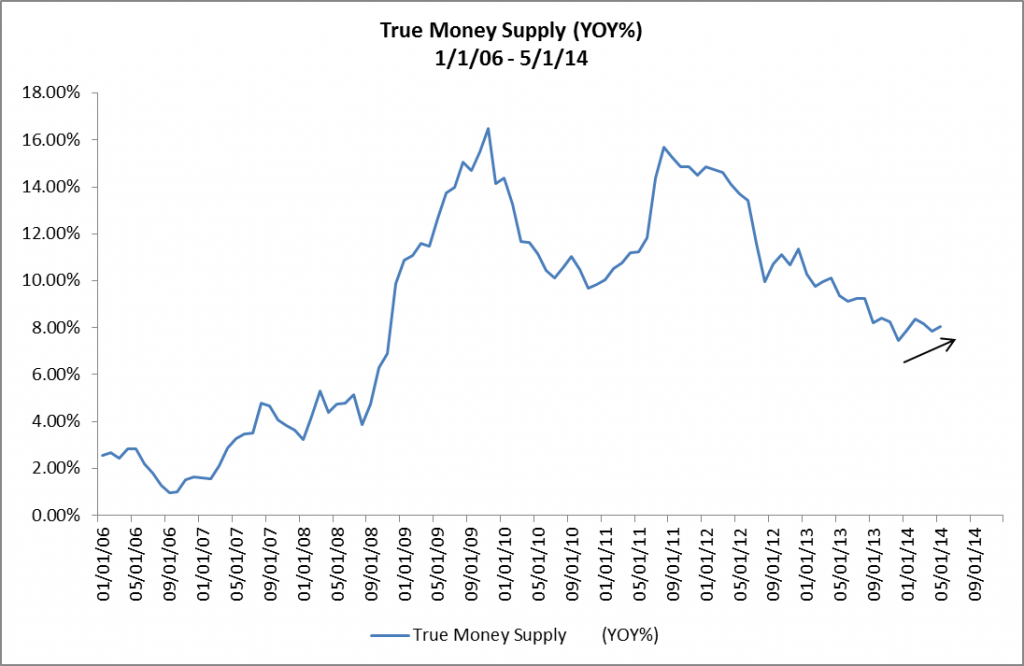

As a result of the Fed’s tapering policy, I would have expected the growth rate of TMS to continue to decelerate during the first part of 2014. I was surprised to learn instead that the TMS growth rate accelerated slightly during the first five months of the year. (See Figure 2.)

Figure 2: True Money Supply (YOY%) 1/1/06 to 5/1/14

According to my Austrian fellow-traveler Michael Pollaro, the recent acceleration in the growth of TMS can be explained by looking separately at the two sources of TMS — Base Money and Uncovered Money Substitutes. Base Money is made up of Currency Outstanding and Reserve Deposits held by the Fed. The rate of growth of Base Money is directly related to the level of the Fed’s bond-buying activity.

The Uncovered Money Substitute portion of TMS is money created by the “pyramiding” of Reserve Deposits through fractional reserve banking. The rate of growth of Uncovered Money Substitutes is directly related to the level of lending by the commercial banks.

Data provided by Michael shows that the recent acceleration in lending activity by commercial banks has more than offset the deceleration in the Fed’s bond-buying activity. It’s too early to tell whether this relationship will continue long enough to be characterized as the beginning of a trend.

Even if it doesn’t develop into a new trend, the interruption in the deceleration of TMS could delay by five or six months the events forecast by RealForecasts.com in recent posts. Keep checking back with RealForecasts.com for future changes in the growth rate of TMS.

As always, thanks to J. Michael Pollaro, author of The Contrarian Take, for the TMS data used to construct the charts in this article.